Portfolio Reviews Are (Mostly) a Waste of Time

When (and Why) to Update Your Portfolio

A few months ago, Taylor (financial advisor, fintech founder, podcast cohost, and friend) was at a football game, catching up with college buddies before kickoff. As tends to happen when people know you’re a financial advisor, the conversation turned to the markets. It had been a rough day on Wall Street — the market was down about 2% — and someone asked, “What did you think about yesterday’s drop?”

He laughed and admitted I hadn’t really looked. He knew roughly what the market had done, but between family and work, he hadn’t followed the play-by-play. That answer got a few puzzled looks.

“What do you mean you didn’t check?” one asked.

Taylor told me later that if it weren’t for those conversations, he probably wouldn’t check the markets as often. Because in the grand scheme, those day-to-day moves don’t really matter.

That exchange got us thinking: how often should you actually review your portfolio — and what should you be looking for when you do?

(a question we answer in even greater depth on podcast episode 24)

Start with the Right Foundation

The most crucial part of portfolio management happens before you ever invest a dollar. If you’ve set things up correctly from the start, you don’t need to keep tinkering with it.

That foundation comes from three questions:

What is this money for? (retirement, college, a home purchase, etc.)

When will you need it? (your time horizon)

How much risk can you handle — both emotionally and financially?

If you’ve invested in a way that matches your goals, time horizon, and comfort with risk, then short-term market moves shouldn’t throw you off course. A properly built portfolio is designed to weather volatility without needing constant attention.

When Markets Are Down

When the market drops, it’s easy to feel like you need to act. A 10%, 5%, or even 3% swing grabs headlines and stirs anxiety.

But market declines are a regular part of investing. Over a 10-year horizon, it’s almost guaranteed you’ll experience a 30–40% decline at some point. That doesn’t mean something’s broken; it means your portfolio is doing what it’s supposed to do.

Each downturn feels unique in the moment (the financial crisis, the pandemic, whatever comes next), but the emotional and behavioral patterns are the same. The investors who stay disciplined through those periods are the ones who benefit most from the recovery that follows. On the other hand, those who sell have to be right twice, and the data is unambiguous that we rarely are. We are evolutionarily predisposed to get this wrong, professionals and day traders alike.

When Markets Are Flying

The opposite problem shows up during bull markets. When stocks hit new highs week after week, it’s tempting to chase the latest “hot” investment or shift your 401(k) toward whatever fund just posted the biggest gains over the last year.

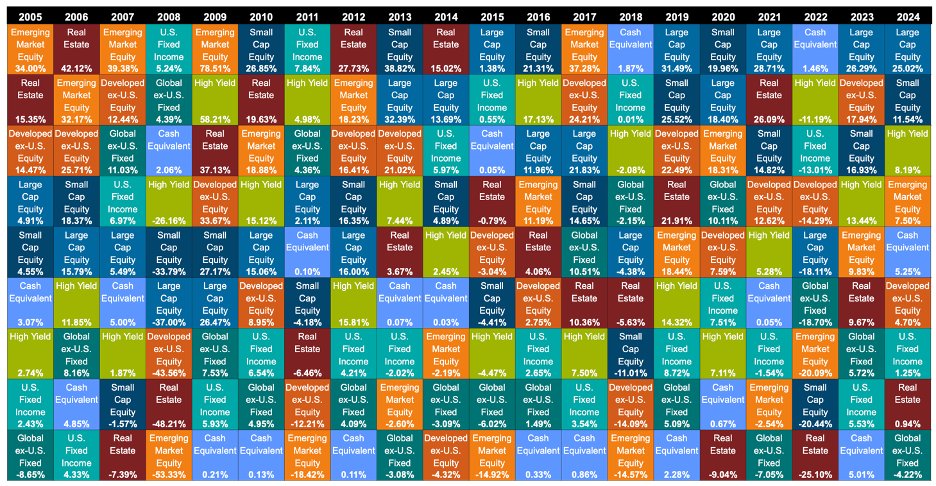

That’s a mistake. Past performance is a poor predictor of future returns, and leadership among asset classes changes constantly. There’s even a chart — sometimes called the periodic table of returns — that shows how last year’s top performer is often next year’s laggard.

The takeaway: diversification and allocation (not prediction) drive long-term success.

If you’ve built a solid, diversified mix that fits your goals, stick with it — even when it feels like everyone else is getting rich faster.

When You Actually Should Make a Change

There are legitimate reasons to update your investment allocation, but they usually have little to do with the market itself.

You should consider changes when:

Your time horizon shifts — for example, you’re within a decade of retirement when you expect to begin withdrawals.

The purpose of the money changes — maybe you’ve sold a business, bought a home, or started funding education expenses.

Your risk capacity changes — life events can reshape how much volatility you can realistically afford to take on.

Those moments don’t happen often, but when they do, it’s worth re-evaluating. Even then, the best adjustments tend to be gradual, not sudden.

Keep in mind that risk tolerance — how you feel about risk — is notoriously unreliable as a guide for action. It tends to rise and fall with recent market performance: everyone feels brave in bull markets and cautious in bear markets. Making allocation decisions based on those emotions is usually counterproductive, which is why I purposely left “changes in risk tolerance” off this list.

Maintenance Matters

There are a few ongoing portfolio “housekeeping” items that do make sense:

Rebalancing once a year at most (or when allocations drift too far) to keep your portfolio aligned with your targets.

Tax-loss harvesting when appropriate — though it’s not a magic bullet, and you shouldn’t let taxes drive investment decisions.

Charitable giving from appreciated stock rather than cash can be a tax-efficient way to support causes you care about.

Implementing gradual allocation shifts in the decade before retirement — slowly reducing equity exposure instead of making one big change at the finish line.

These are thoughtful, proactive steps — not emotional reactions to what the market did last week.

The Real Annual Review

An “portfolio review” often sounds like sitting down to discuss returns and charts. Many advisors will draw attention to recent performance to demonstrate their prowess when times are good, and deflect blame or counsel patience when they’re not. This type of annual (or god forbid, quarterly) review is typically a waste of time.

The real value comes from updating your financial plan:

How have your goals changed?

Has your time horizon shortened?

Has your income, spending, or risk capacity shifted?

If not, there may be nothing to fix. In fact, the best outcome is often confirming that your plan is still on track and requires no major changes.

The Less You Look, the Better

As a financial advisor, friends often look to me to have something smart to say when the markets move. But successful investing isn’t about having something to say at a tailgate or family gathering; it’s about cultivating the habits that quietly create wealth over time.

If you have a well-designed plan, the less you check your portfolio, the more likely you are to let it do its job. Long-term investing like this may feel boring, but nothing is boring about actually achieving your goals.