Articles by Oakleigh Wealth

Portfolio Reviews Are (Mostly) a Waste of Time

A few weeks ago, Taylor (financial advisor, friend, and podcast cohost) was at the OU–Texas football game, catching up with college buddies before kickoff. As tends to happen when people know you’re a financial advisor, the conversation turned to the markets. It had been a rough day on Wall Street — the market was down about 2% — and someone asked, “What did you think about yesterday’s drop?”

He laughed and admitted I hadn’t really looked. He knew roughly what the market had done, but between family and work, he hadn’t followed the play-by-play. That answer got a few puzzled looks.

“What do you mean you didn’t check?” one asked.

Taylor told me later that if it weren’t for those conversations, he probably wouldn’t check the markets as often. Because in the grand scheme, those day-to-day moves don’t really matter.

That exchange got us thinking: how often should you actually review your portfolio — and what should you be looking for when you do?

A Big Change to 401(k) Catch-Up Contributions Is Coming in 2026

Thanks to changes enacted under the SECURE 2.0 Act, starting in 2026, many catch-up contributions will be required to be made as Roth contributions, meaning after-tax rather than pre-tax. This is a meaningful shift, and one that deserves some advance planning.

Let’s walk through what’s changing, who it applies to, and how to think about it.

Beyond Resilience: Building an Antifragile Retirement

If there’s one thing I’ve learned working with families in retirement, it’s this: life rarely unfolds according to the spreadsheet. Markets move, health changes, families grow, opportunities arise. Some surprises are wonderful, others are extremely difficult.

The families who thrive are the ones who can adapt. Flexibility in retirement doesn’t mean giving up control. It means creating a plan that can bend without breaking. It’s about leaving room for change, so that when life doesn’t go according to plan, you still have choices.

This idea lines up beautifully with the work of Nassim Nicholas Taleb, whose book Antifragile explores how certain systems don’t just survive stress but actually grow stronger from it.

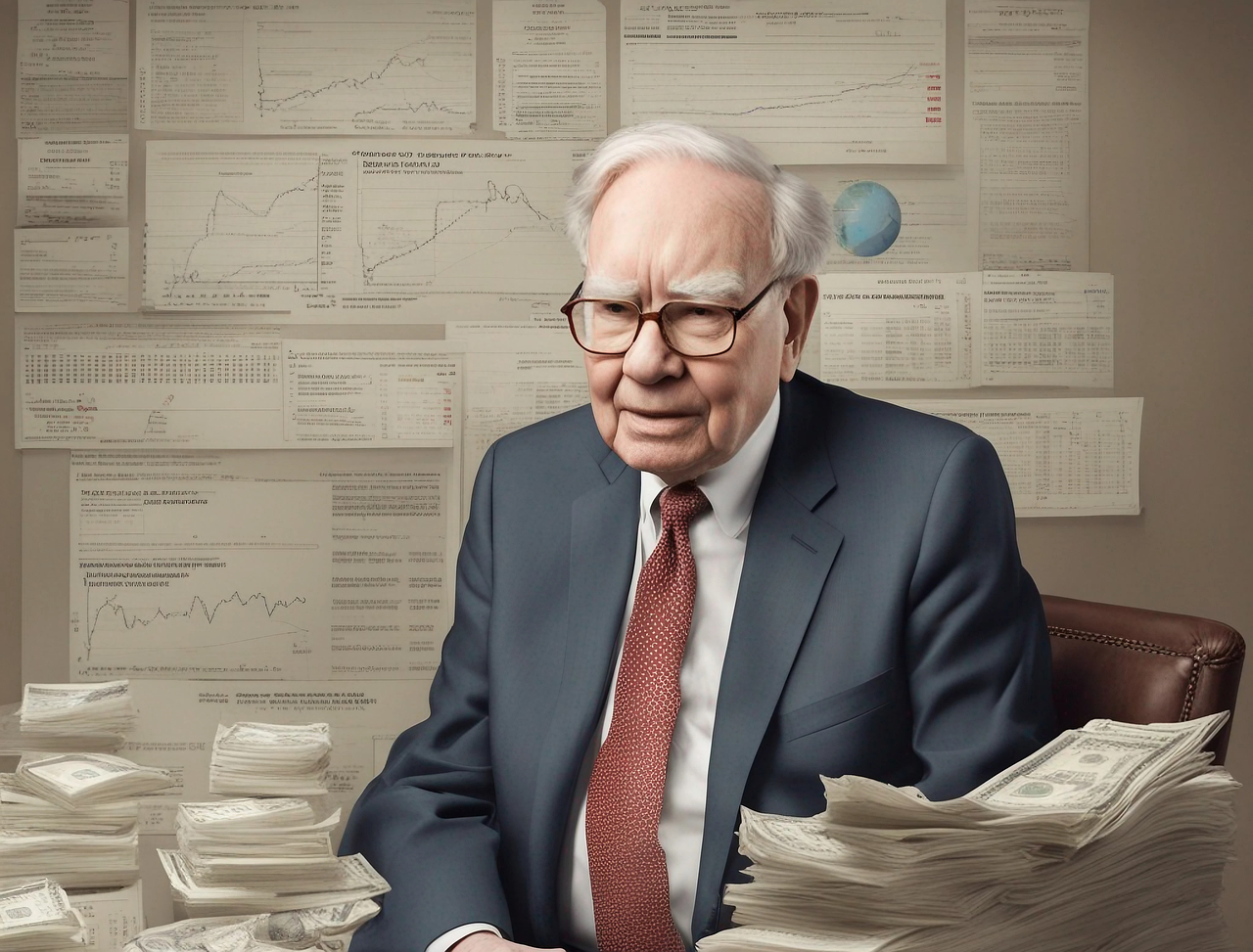

Buffet has the highest cash balances of all time; should I sell everything?

A family member texted me after seeing headlines following Warren Buffett's annual letter to Berkshire Hathaway's shareholders (read the full letter here). A smattering of headlines read: "Warren Buffett amasses more cash and sells more stock" and "Why Warren Buffett's cash pile is growing, and what it means for markets."

In other words, "Is it time to get out of the market?"

Rolling funds from a 529 acocunt to a Roth IRA

A 529 plan is traditionally known for its role in helping families save for education expenses. However, recent legislative changes have introduced an exciting new possibility: the ability to roll over unused funds from a 529 account into a Roth IRA for the beneficiary. This feature can be a powerful tool for jump-starting retirement savings, but it comes with specific rules and limitations. Here’s what you need to know.

Should I take My Pension as a Lump Sum?

For many, employer pensions are a key part of retirement planning. While these plans are increasingly rare, they often represent a significant portion of anticipated retirement income. If you're nearing retirement or already receiving pension payments, you may face an important decision: Should you opt for a lump sum distribution or continue receiving a lifetime stream of payments?

529 Plan Hack: Maximizing state tax benefits by routing education expenses through a 529 plan.

529 plans are a powerful tools for funding education in the United States, offering tax-free growth and withdrawals for qualified expenses. In some states, they also come with an attractive bonus: state income tax deductions or credits for contributions.

While these incentives are designed to encourage long-term saving for education, savvy families may be able to utilize 529 plans to receive an immediate tax deduction for qualifying education expenses they are paying for now.

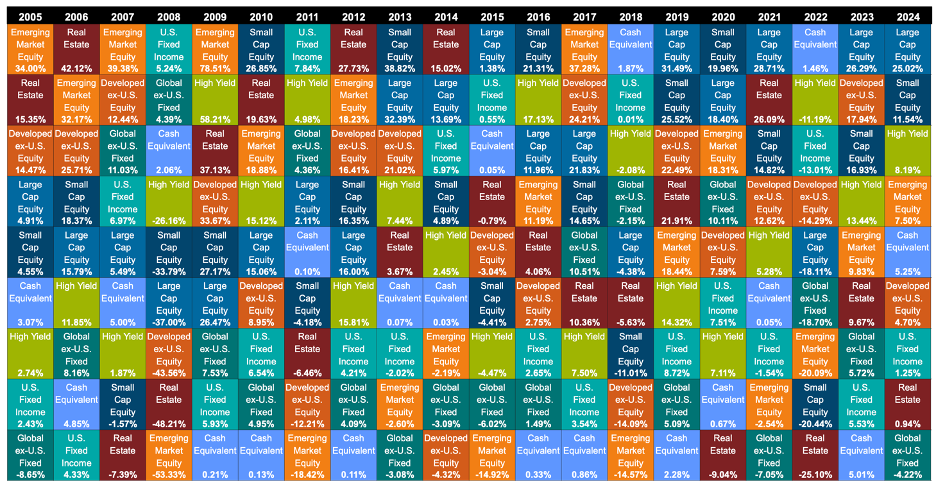

Investing Success

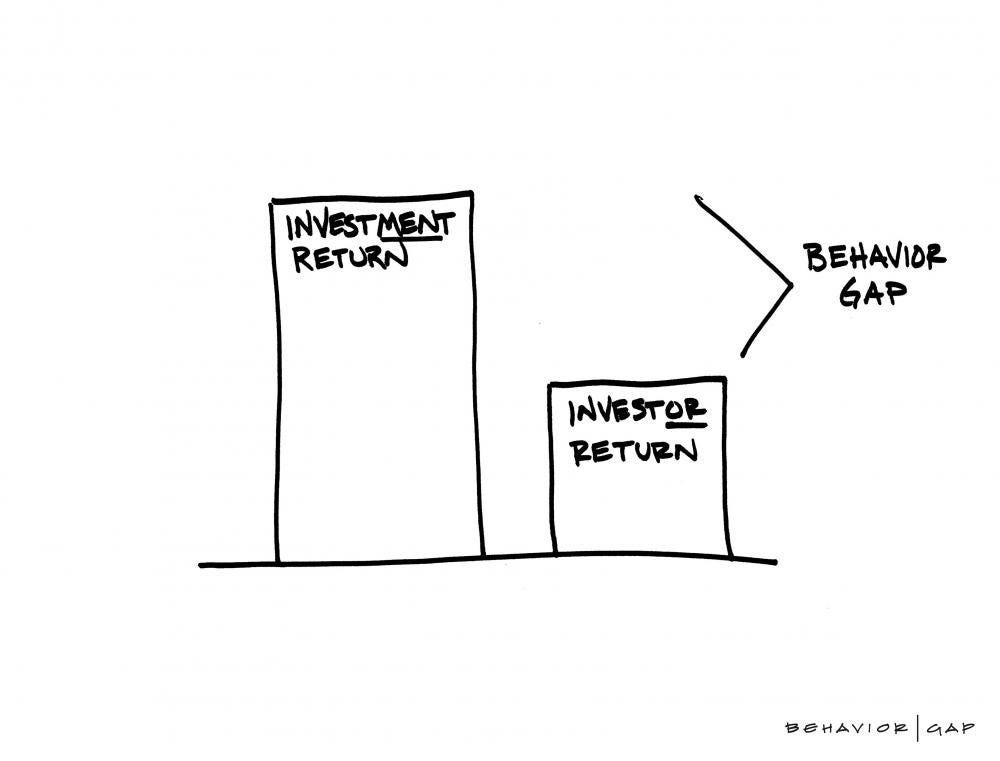

Investing success is more a function of behavior than skill or technical ability. The context in which we’ve grown up, our past experiences, and the biases we carry shape how we measure success and profoundly influence our perception of risk.

This post focuses on what I think are the two most fundamental topics in all of investing:

The Risk/Return Tradeoff

The Behavior Gap

Cash is King

Liquidity refers to how quickly an asset can be converted to cash. Our financial lives depend on access to cash. Cash is king, whether it’s paper currency, figures in your checking account, or the ability to borrow it instantly with the swipe of a magnetized plastic rectangle.

This post explores what constitutes liquidity, why you need it, and how much you should have. There’s no right answer, only tradeoffs.

Planning for long-term care in retirement

Insurance works best to cover risks that are both low in frequency and high in severity (car accidents, house fires, premature death, or disability). This is why LTC is so difficult to plan for: It’s not all that low in frequency, but it can also wreck your retirement plan. These two things conspire to make LTC much more expensive to insure against (whether that’s self-insuring or purchasing an insurance policy).

I-Bonds ain’t what they used to be

Did you buy I-bonds in 2022 when they paid some of their highest-ever interest rates? That bond you bought in May of 2022 with a 9.62% annualized interest rate is now paying only 3.94% and this will be cut again on May 1st. For comparison, current money market rates are north of 5% and one-year treasuries are paying 5.16%.

Risk Tolerance & Risk Capacity

Determining the right investment strategy is crucial for achieving long-term financial goals. Two key factors that play a pivotal role in shaping an individual's investment approach are risk tolerance and risk capacity. While these terms are often used interchangeably, they carry distinct meanings, each influencing how investors should approach investment selection.

What Issues Should I Consider Before the End of the Year?

Tracking numerous deadlines and avoiding missed planning opportunities can be challenging during these busy months. To help ensure that you remain on track, we have a checklist that outlines 18 time-sensitive considerations to guide your end-of-year review and tee up any adjustments for the coming year

Look beyond bonds for sustainable retirement income

With the recent increase in interest rates, retirees or those nearing retirement might find it tempting to invest their nest eggs in longer-dated government bonds to secure a stable, long-term income. After enduring the "Great Financial Crisis," it's understandable why exiting the stock market might seem appealing. When you have only a few working years left or have already retired, the prospect of another market downturn can be quite daunting.

However, following this line of thinking could lead you into trouble!

Maximizing Your HSA’s Full Potential: Stop Using It Like an Expense Account

Health Savings Accounts (HSAs) allow you to pay for a wide variety of qualifying healthcare expenses with pre-tax dollars. But this may not be the best use of your HSA funds (at least not now).

If you have the financial means to pay your healthcare costs directly, you might find greater value in treating your HSA as a long-term retirement savings tool rather than a healthcare checking account. This is particularly advantageous if you are younger, in relatively good health, and can afford to pay for minor medical expenses out of pocket. In the long run, it may be in your best interest to invest those HSA dollars for the long term, allowing the balance to grow and compound tax-free for use later in life or in an emergency.

Can I make a “Mega Backdoor Roth” Contribution?

Say you have maxed out your pre-tax IRA and 401(k) contributions (or Roth IRA and Roth 401(k), if current tax rates are lower) and you still have the ability to save more, you don't need liquidity and want to do it as tax efficiently as possible.

In certain cases, you may be eligible to make a Mega Backdoor Roth contribution and contribute tens of thousands more to your Roth IRA, regardless of your income level.

Equity Compensation: opportunities, risks, biases, and taxes

Long the domain of only the C-suite and key employees, equity compensation is increasingly used to motivate and retain younger and mid-level employees of the leanest startups to the largest public and private enterprises.

But, while these programs offer the potential for significant wealth accumulation, they also increase the level of risk the employee and her family are exposed to should the company take a turn for the worse. Armed with the knowledge of how these programs work and how they fit within your overall financial plan, you can take advantage of them from a position of clarity and security.

Restricted Stock Units (RSUs)

RSUs are one of the simplest and most common forms of equity compensation. They are essentially a promise of a given quantity of stock at a future date. Once the shares are vested and taxes are accounted for, you own the company stock just as if you had purchased it on your own. The key question to ask yourself when deciding whether to hold the shares or sell them immediately is this: “If I got a cash bonus instead, would I use it to buy shares in my company?” If not, that’s a good indication that you should just cash out now, or as the Steve Miller Band put it, “Go ahead, take the money and run!”

To Roth or Not to Roth? Deciding Between Roth and Tax-Deferred Savings

The decision of whether to contribute to a Roth or a traditional retirement account basically boils down to timing: do I pay taxes now or later? While both types of retirement accounts are powerful tools for building wealth, this seemingly simple binary can produce some unique planning opportunities with meaningful tax savings for many individuals.

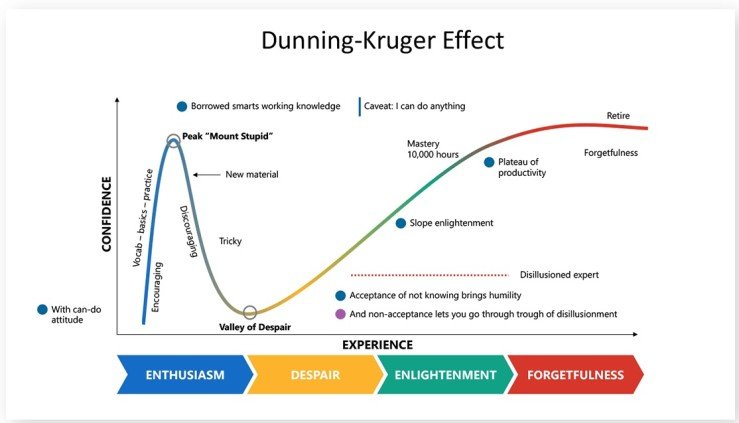

The Dunning-Kruger Effect (in investing (and life)

Dunning & Kruger’s study demonstrated something we all know to be true from experience: people with low levels of knowledge, skill, or competence tend to overestimate their own abilities. Their findings have broad implications for personal finance and investing, but it also raises broader questions about the human experience more generally. We are all prone to over confidence. Mastery, in any arena of life, requires that we overcome the despair of failure through dilligence and humility. But is that all there is?