Articles by Oakleigh Wealth

Open Enrollment: Don’t Just Click “Repeat” This Year

Every fall, millions of employees (and retirees) face the same task: reviewing their benefits during open enrollment. And if you’re like most people, you might be tempted to simply check “same as last year” and move on.

I get it—benefits paperwork isn’t anyone’s idea of fun. But the truth is, these choices can have a meaningful impact on your finances and your peace of mind for the year ahead. Spending even an hour thinking them through can pay off in real dollars.

Here’s how to approach open enrollment with a clear framework so you can make smart, confident choices.

John D’earth’s Retirement

Two weeks ago, The Daily Progress, Charlottesville’s local newspaper, featured one of the most inspiring retirement announcements I’ve ever read. John D’earth—the legendary jazz trumpeter, bandleader, and director of jazz performance at UVa—officially “retired” this past December.

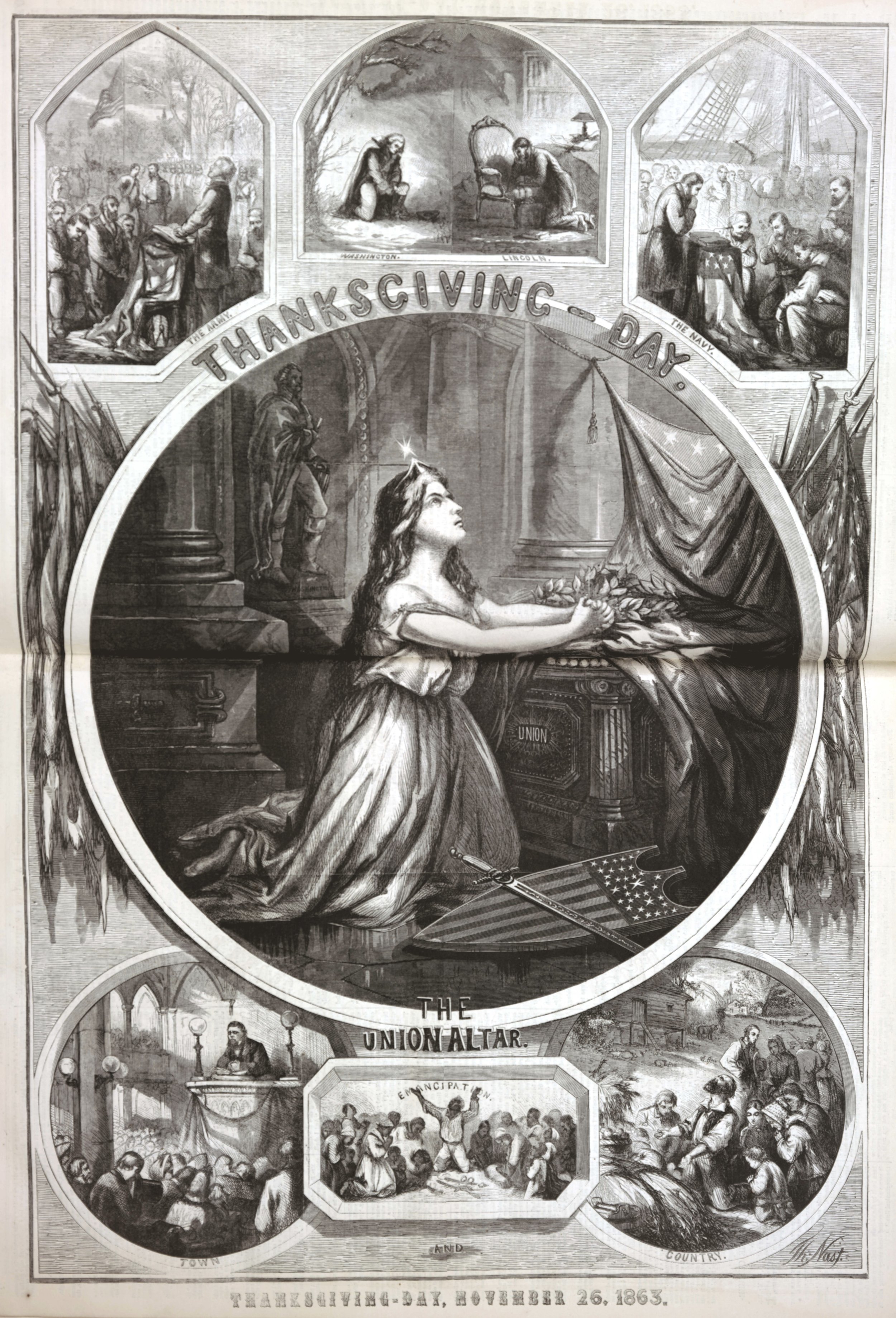

A Proclamation of Thanksgiving

This past Sunday, I heard this excerpt from Abraham Lincoln’s Thanksgiving Proclamation of 1863. It was penned mere months after Gettysburg, the bloodiest battle of the American Civil War. It was a year of perilous uncertainty when our nation was on the brink of moral and political collapse, and families were bitterly divided and grieving. And yet, even amidst strife and humbling loss, Lincoln extolled his hopeful thanksgiving for the nation’s many blessings.

Halloween is the most altruistic holiday of the year

This sentiment may be somewhat of a “hot take.” Notwithstanding the candy-hoarding tendencies of my five- and ten-year-old, I would argue that this single sugar-filled night may be the most generous and communal holiday. This bold assertion even includes the fast-approaching pseudo-secular holidays of Thanksgiving, Christmas and Hanukkah that are now only weeks away, (even though Costco has been selling fake trees and 10-foot light-up lawn ornaments since August).

Social Security Strategies

The majority of Americans depend on two main sources of retirement income: their investment portfolio and their social security benefits. It’s no wonder then that the financial stability of this popular and important program is politically sacrosanct or that it receives so much media attention. And yet, so many Americans, (particularly those who rely most on the benefits), don’t have a good framework for making the optimal claiming strategy.

Making the most of your money

My friend Taylor and I were talking recently about why folks seek out financial advice, and he summed it up like this: "They want to feel like they are making the most of their money."

At first blush, it sounds like our job is to help people make more money, but that's not what he meant. Everyone wants to know that they're making good decisions with their money, that they're not missing out, that they’re not exposing themselves and their families to undue risk, and that they're not being taken advantage of.

How to find your financial purpose

Have you ever watched a new sport? One of the first things to understand is “How do you win?” meaning, what is the ultimate goal? Is it the highest score (e.g., football)? Lowest score (e.g., golf)? How do you score in the first place?

We rarely ask that about life itself. We live and then later look back, wondering what the hell we’ve been doing all these years. Read on to learn how to start asking— and answering— that question about life itself.

The 6 variables you can actually control

Personal finance can be overwhelming. Here’s the good news. There are only six variables you can actually control. Everything else is out of your hands. Do what you can with those six variables to give yourself the best chance of pursuing your financial purpose, and from there, life will be what it will be.

Personal finance is simple, but hard

Personal finance is pretty simple. If you save 20% of your income, have proper liquidity, carry basic insurance (home, auto, liability, life, disability), and invest your long-term money in a low-cost diversified index fund (and don’t sell), you’ll probably be just fine.

While it may be that simple, it’s also hard.

Open Letter Re: Changes at Oakleigh

It had always been my goal to be a financial planner who is a “general practitioner” or a “jack of all trades.” I love exploring the universal issues we all have around money as well as digging into a broad range of topics. However, I have also come to realize the drawbacks of such a wide focus, especially as a solo practitioner. I never want to compromise on providing excellent client service, expertise, and transparent value for each of my clients.

10 Free & Effective Ways to Protect Yourself from Identity Theft

The threat of identity theft looms larger than ever before. Cybercriminals are constantly finding new ways to steal personal information and wreak havoc on your financial well-being. Protecting yourself from identity theft is an essential piece of a comprehensive financial plan. Here are ten inexpensive and effective things you should be doing to safeguard your identity:

Defining the Elements

At Oakleigh, we use an app called Elements to show a quick snapshot of your financial health and track specific key metrics over time. This is very similar to how a doctor might track your vital signs to understand your physical health and quickly diagnose specific issues. Of course, there’s a story behind all of these numbers and we would dive much deeper for a full financial planning engagement. However, you might be surprised by how many important issues can be uncovered and addressed from these high-level metrics alone.

Financial Assessment for a Couple In their Mid-30s

Ever wondered what a financial assessment looks like? Here’s an example assessment of a married couple in their mid-30s with two young children. Mike is an architect working for a larger firm making $95k per year and his wife Mary just received a raise at the consulting firm she works for, and is now making $260k per year after finishing an executive MBA program. They have two children in daycare, but they feel like they should be able to do more with the good money they’re making now, but life just continues to get more complicated.

A Transparent Look at “Fee-Only” Financial Advising

There are so many different types of “financial advisors” in the marketplace, there’s no wonder that many folks lump them all together into one. Tell someone you’re a financial advisor at a party and they’ll either ask you for your latest stock tip, or they’ll quietly shift their wallet to their front pocket so they can keep an eye on it! In my experience, sadly, the latter is probably the more rational response!

What’s with the name Oakleigh?

When I was 11, my family moved into a neighborhood called Oakleigh Forest, a modest, multi-generational, suburban community near Annapolis, MD made up of hard-working professionals, public servants, and small business owners. It also happened to be the same neighborhood where my father had grown up, and where my newly retired grandparents still resided in that same house down the street.