Articles by Oakleigh Wealth

Portfolio Reviews Are (Mostly) a Waste of Time

A few weeks ago, Taylor (financial advisor, friend, and podcast cohost) was at the OU–Texas football game, catching up with college buddies before kickoff. As tends to happen when people know you’re a financial advisor, the conversation turned to the markets. It had been a rough day on Wall Street — the market was down about 2% — and someone asked, “What did you think about yesterday’s drop?”

He laughed and admitted I hadn’t really looked. He knew roughly what the market had done, but between family and work, he hadn’t followed the play-by-play. That answer got a few puzzled looks.

“What do you mean you didn’t check?” one asked.

Taylor told me later that if it weren’t for those conversations, he probably wouldn’t check the markets as often. Because in the grand scheme, those day-to-day moves don’t really matter.

That exchange got us thinking: how often should you actually review your portfolio — and what should you be looking for when you do?

A Big Change to 401(k) Catch-Up Contributions Is Coming in 2026

Thanks to changes enacted under the SECURE 2.0 Act, starting in 2026, many catch-up contributions will be required to be made as Roth contributions, meaning after-tax rather than pre-tax. This is a meaningful shift, and one that deserves some advance planning.

Let’s walk through what’s changing, who it applies to, and how to think about it.

Wherever You Go, There You Are

Over Thanksgiving, our family spent a week in Sicily, where we rented a home with close friends and their four children. It was one of those trips that checks all the obvious boxes: beautiful scenery, unforgettable food, layered history, and the kind of slow evenings and deep conversations that only happen when you’re far from normal routines. It was a week filled with laughter and adventure, but also chaotic mornings, tired kids, and all the familiar dynamics that come with traveling as families who know each other well.

In other words, it was wonderful. And it was real.

Using Your HSA in Retirement

For many retirees, healthcare is the biggest wild card in the plan. In retirement, Health Savings Accounts (HSAs) give you a lot of flexibility and tax advantages that other accounts do not.

HSAs have a rare triple tax advantage: contributions are deductible, growth is tax-free, and withdrawals are tax-free when used for qualified medical expenses.

Below is a simple guide to what is and is not allowed, how to use the popular “shoebox” strategy, and how HSAs can support long-term care needs

Spear Phishing Scams: A Growing Threat for Seniors

Fraud targeting older adults is reaching crisis levels—and the numbers are staggering. According to the latest FTC Data Spotlight (August 2025), Americans over 60 lost a record $700 million to imposter and phishing scams in 2024 alone—more than five times the amount reported just four years earlier. The FBI’s 2024 Internet Crime Report paints an even grimmer picture: seniors lost a total of $4.9 billion to scams last year, a shocking 43% increase over 2023. Not only are older adults reporting the most complaints of any age group, but their average losses—at $83,000 per victim—far exceed those of younger generations.

What’s driving this alarming surge? Scammers are leveraging sophisticated spear phishing tactics, often powered by artificial intelligence, to craft convincing messages that prey on life transitions, emotional vulnerability, and social isolation. These attacks are meticulously researched, highly personalized, and increasingly difficult to detect—even for the tech-savvy.

In this post, we’ll break down how spear phishing scams work, why retirees are prime targets, the emotional and financial toll these crimes inflict, and—most importantly—how you and your loved ones can recognize the red flags and stay protected.

Open Enrollment: Don’t Just Click “Repeat” This Year

Every fall, millions of employees (and retirees) face the same task: reviewing their benefits during open enrollment. And if you’re like most people, you might be tempted to simply check “same as last year” and move on.

I get it—benefits paperwork isn’t anyone’s idea of fun. But the truth is, these choices can have a meaningful impact on your finances and your peace of mind for the year ahead. Spending even an hour thinking them through can pay off in real dollars.

Here’s how to approach open enrollment with a clear framework so you can make smart, confident choices.

How to Evaluate Your Medicare Part D Drug Coverage

When it comes to Medicare, one area that deserves an annual check-up is your prescription drug coverage. Many retirees don’t realize that while Medicare Supplement (Medigap) policies generally lock you into your original carrier and plan, Medicare Part D drug plans are different. You can review and change your Part D plan every year during the Annual Enrollment Period (October 15 – December 7). Any changes you make will take effect on January 1. That flexibility is valuable — but only if you take the time to compare your options.

Beyond Resilience: Building an Antifragile Retirement

If there’s one thing I’ve learned working with families in retirement, it’s this: life rarely unfolds according to the spreadsheet. Markets move, health changes, families grow, opportunities arise. Some surprises are wonderful, others are extremely difficult.

The families who thrive are the ones who can adapt. Flexibility in retirement doesn’t mean giving up control. It means creating a plan that can bend without breaking. It’s about leaving room for change, so that when life doesn’t go according to plan, you still have choices.

This idea lines up beautifully with the work of Nassim Nicholas Taleb, whose book Antifragile explores how certain systems don’t just survive stress but actually grow stronger from it.

How Much Do You Need to Carry With You?

Packing light isn't just about luggage—it’s a metaphor. We carry more than we realize: fears, regrets, habits, busyness, expectations. Some of that “stuff” once served a purpose. But over time, it can become a burden.

Introducing Wealth.com: DIY Estate Planning with Advisor Support

Estate planning doesn’t have to be overwhelming. With Wealth.com, you can create a legally valid will or trust from the comfort of your home—no attorney required (unless you want one). This modern platform walks you through each step, and while Oakleigh Wealth doesn’t provide legal advice, we’re here to help you understand the key terms and decisions along the way.

Beauty is in the Eye of the Beholder: What the OBBBA Means for Your Taxes and Planning

On July 4, 2025, the “One Big Beautiful Bill Act” (OBBBA) was signed into law. While the name might sound like a joke, the changes it introduces to the tax code are very real, and they’ll affect nearly every household in some way, especially retirees and those approaching retirement.

Why Financial Projections Are Both Helpful—and Misleading

We humans like to know what’s coming. That’s why weather forecasts exist. And financial forecasts. And why so many people think of projections as the heart of financial planning.

And there’s some truth to that. Seeing your financial life mapped out over time—how your savings might grow, how your expenses will evolve—can be incredibly clarifying. But if we’re not careful, those projections can give us a false sense of certainty. They can feel like a crystal ball when they’re really just a spreadsheet.

This month, I recorded a podcast episode exploring the pros and cons of financial projections: when they’re useful, how they can go wrong, and what to focus on instead. Below are a few key takeaways.

Why Reviewing Your Beneficiaries Should Be Part of Your Regular Financial Checkup

When it comes to estate planning, one of the most overlooked—but most important—steps is reviewing your beneficiary designations. These designations can override the instructions in your will or trust, which is why they warrant regular attention.

A Closer Look at Hybrid or “Asset-Based” Long-Term Care Insurance

In a recent episode of the Make the Most of Your Money podcast, we spoke with insurance specialist Roger Cantu about how to protect your family and finances from the emotional and financial strain of a long-term care event. One solution is a hybrid or asset-based long term care insurance policy, which overcomes some key issues with traditional LTC insurance plans. This type of LTC policy is worth a closer look.

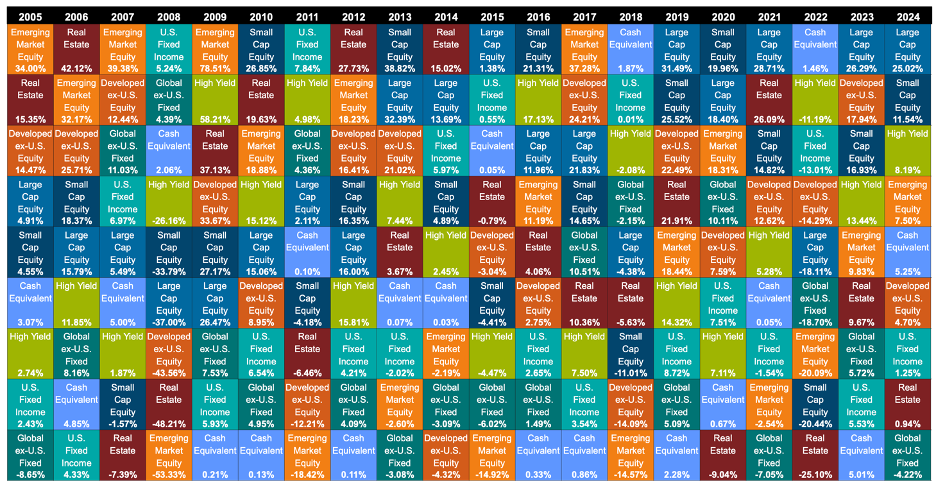

What to Do When the Market Drops: Bear Market Action Plan

It’s never easy to watch the market decline. While we know intellectually that staying disciplined is the right move, removing emotion from financial decisions is hard—especially when there’s always a real and unsettling reason behind the drop. Whether it’s a pandemic, financial panic, or global instability, downturns never feel like just numbers on a screen; they come with headlines that make it tempting to act. The highly charged 24/7 media cycle that follows you everywhere in your pocket doesn’t help either.

But history has shown that staying strategic, not emotional, leads to better long-term results. Still, there are things you can do to take advantage of market downturns instead of reacting emotionally.

Here’s a simple action plan based on how much the market has declined:

How to pay your taxes online

Whether you need to make estimated tax payments throughout the year, pay a balance due when filing your return, or submit a payment with your tax extension, making an electronic payment from your bank account is the fastest and most secure way. Below are step-by-step instructions to guide you through making these payments to the IRS.

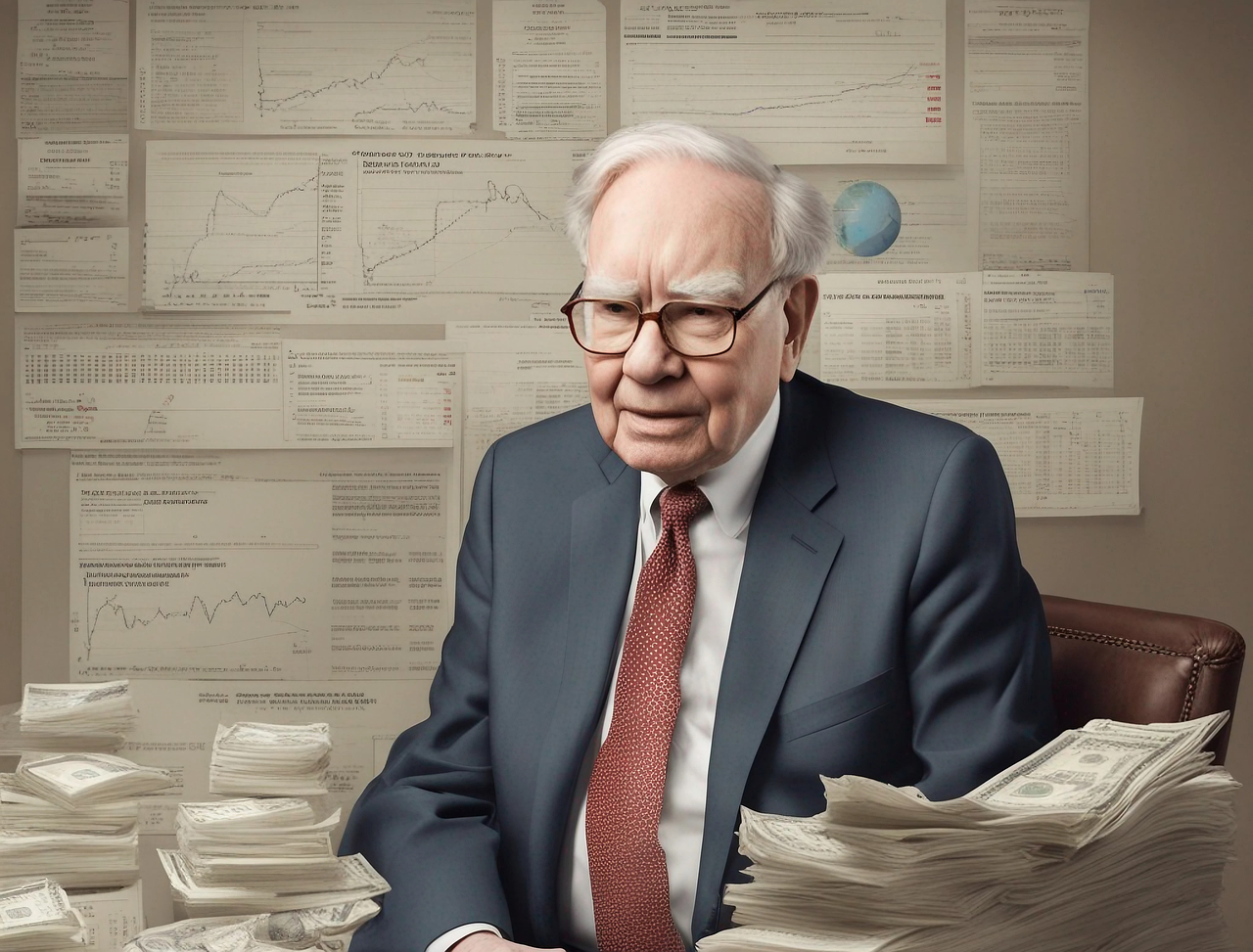

Buffet has the highest cash balances of all time; should I sell everything?

A family member texted me after seeing headlines following Warren Buffett's annual letter to Berkshire Hathaway's shareholders (read the full letter here). A smattering of headlines read: "Warren Buffett amasses more cash and sells more stock" and "Why Warren Buffett's cash pile is growing, and what it means for markets."

In other words, "Is it time to get out of the market?"

The Backdoor Roth IRA

Roth IRA accounts are one of the most tax efficient retirement savings vehicles. But if your income is over the phase-out limits, you will not be able to contribute directly to your Roth IRA. Enter the so-called “backdoor Roth,” a loophole which allows you to add to your Roth IRA when your income is otherwise over the limit. BUT… it doesn’t come without risk.

John D’earth’s Retirement

Two weeks ago, The Daily Progress, Charlottesville’s local newspaper, featured one of the most inspiring retirement announcements I’ve ever read. John D’earth—the legendary jazz trumpeter, bandleader, and director of jazz performance at UVa—officially “retired” this past December.

Rolling funds from a 529 acocunt to a Roth IRA

A 529 plan is traditionally known for its role in helping families save for education expenses. However, recent legislative changes have introduced an exciting new possibility: the ability to roll over unused funds from a 529 account into a Roth IRA for the beneficiary. This feature can be a powerful tool for jump-starting retirement savings, but it comes with specific rules and limitations. Here’s what you need to know.